Plan design options The big difference between 401k plan designs is how and when an employer makes contributions on behalf of its employees. This plan gives employers the flexibility to make outright contributions to employee accounts.

Improvement Opportunity Checklist For Dc Plan Sponsors 401k Plan Optimization Compliance Investment Partners

Communicate with plan administrators to ensure proper employee classification and compliance with the plan terms.

. Interior Design Handbook of Professional Practice. You can easily make the address update online and set it for a specific start date. If there is no plan in place it will be up to your HR professional to develop an HR department from the ground up.

I RA I I MA Governance Example and Governance Word Template. Review the plan document sections on eligibility and participation. Get Certified Copies of Your Marriage Certificate.

Investors in TIPS accept lower yields because their principal value and coupon payments rise when inflation rises. 6 Eligible employees werent given the opportunity to make an elective deferral exclusion of eligible employees. Z Income under a nonqualified deferred compensation plan that fails to satisfy Section 409A.

Full PDF Package Download Full PDF Package. They can do this by following our step-by-step HR department startup checklist and taking time to implement each aspect in a way that best suits your businesss needs. Here are three types of plan designs their requirements and some other implications.

The Federal Government advises organizations to communicate with plan administrators to ensure proper employee classification and compliance with the plan terms If your company sponsors a 401k benefits plan make sure you dont fall victim to these discrimination issues. 401K rollover funds are reported as distributions even when they are rolled over into another eligible retirement account. Estate Planning Checklist Choosing an Attorney Estate Taxes.

This change of address checklist will fill you in on who you need to give a heads up to about your new home. Drives development of the overall integration plan including all the integration projects communication plans and achievement of synergy benefits I RA C C Defines and manages integration processes including functional work plan reviews cross-functional collaborations issue management. To treat all your employees fairly and stay compliant with the IRS there are a few design-based safe harbor methods you can use to allocate profit sharing contributions.

The post office. Consider a safe harbor or automatic enrollment plan design. This is by design.

Consult with the IRS to make sure your program complies with. Standard profit sharing 401k plan. Rollover distributions are exempt from tax when you place the funds in another IRA account within 60 days from the date of distribution.

Enter a keyword below to find answers to your AARP Research questions. An eligible rollover of funds from one IRA to another is a non-taxable transaction. Regarding rolling 401K into IRA you.

Start here since notifying the post office of your change of address will get any mail sent to your old place forwarded to your new one for 12 months. News Alerts Sign up for a monthly newsletter of the latest AARP Research. The new digital habits adults 50 adopted during the COVID-19 pandemic are here to stay.

Lets say you decide to. Download Full PDF Package. You can tackle the rest of the checklist in the order that makes the most sense for you but youll want to stick to the order of steps weve outlined here.

See Form 1040 instructions Schedule 2 line 17h Other Taxes for more. Research on issues and topics of particular interest to the 50. This amount is also included in Box 1 and is subject to an additional 20 tax plus interest.

26 Full PDFs related to this paper. A short summary of this paper. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

Y Deferrals under a Section 409A nonqualified deferred compensation plan. The first steps in legally changing your name after marriage involve. When you decide to make a contribution to your profit sharing plan you do so by setting aside a pool of money that will be contributed across all your eligible employees.

Plan and Invest with an advisor How We Compare. Plan your wedding wherever and whenever you want on the WeddingWire App. That said its important to consider the break-even inflation rateor the difference in yields of a TIPS and a comparable.

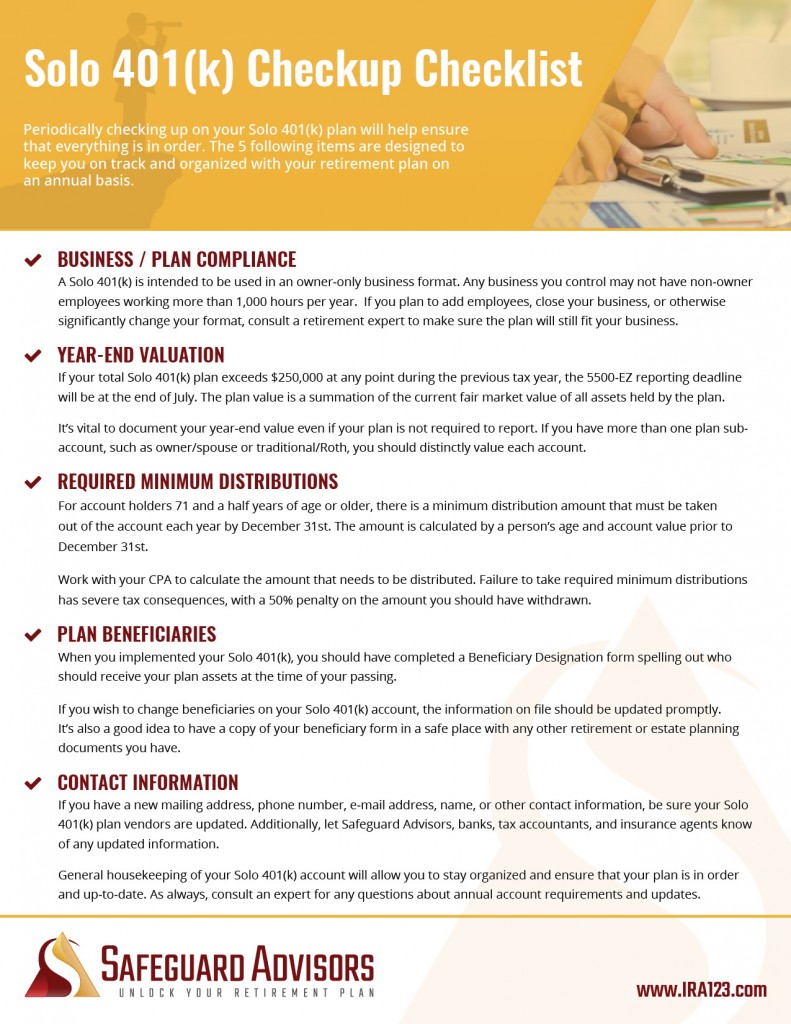

Solo 401 K Checkup Checklist Safeguard Advisors

401 K Plan Checklist Independent 401 K

Infographic Plan Sponsor Plan Questionnaire Investment Solutions Group

401 K Plan Administration Checklist For The 2019 Plan Year By Eric Droblyen Medium

401 K Plan Administration Checklist For The 2019 Plan Year By Eric Droblyen Medium

0 comments

Post a Comment